For a startup in Kenya, the journey to success is often exhilarating, filled with innovation, market disruption, and rapid growth. However, amidst the excitement of building a thriving business, one critical area that often gets overlooked, yet carries significant implications, is tax compliance. Specifically, understanding and managing Withholding Tax in Kenya (WHT) is paramount.

Many Kenyan entrepreneurs, particularly those just starting out or running Small and Medium-sized Enterprises (SMEs), can find the tax landscape complex and daunting. They might focus heavily on sales, product development, or team building, sometimes pushing tax obligations to the back burner. This can be a costly mistake. For instance, according to a report by Afrilink Business Consultants, neglecting tax compliance doesn’t just lead to hefty fines; it can erode your business’s reputation and significantly limit growth opportunities.

This comprehensive guide is designed to be your go-to resource for navigating the intricacies of Withholding Tax in Kenya. We’ll demystify what WHT is, explain why it’s crucial for your startup’s legitimacy and long-term health, detail when and where it applies, and provide practical steps on how to comply. Our aim is to equip you with the knowledge and tools to confidently manage your WHT obligations, ensuring your startup thrives without unnecessary tax-related hurdles.

By the end of this article, you’ll have a clear understanding of:

- The fundamental concept of Withholding Tax in Kenya.

- Why WHT compliance is a cornerstone of a credible and successful startup.

- The specific types of payments that attract WHT in the Kenyan context.

- Your role and responsibilities as a payer in the WHT ecosystem.

- Practical steps for calculating, filing, and remitting Withholding Tax in Kenya to the Kenya Revenue Authority (KRA).

Let’s dive in and transform what might seem like a complex tax obligation into a manageable aspect of your startup’s financial operations.

II. What is Withholding Tax in Kenya? (Definition & Basics)

So, what exactly is Withholding Tax in Kenya? In simple terms, it’s a mechanism by which the Kenya Revenue Authority (KRA) collects income tax at the very source of certain payments. Instead of the recipient of the income (like a consultant or landlord) paying their full tax later, a pre-determined portion is “withheld” by the payer (your startup) and directly remitted to KRA.

Think of it as an “advance payment” or an “on-account tax” on behalf of the income recipient. The payer, in this case, your startup, acts as a KRA agent, facilitating the collection of this tax. This system helps the KRA ensure early and consistent tax collection, enhancing overall tax compliance across various sectors of the economy.

Conceptual Frame: Advance Tax Collection

The core idea behind WHT is to broaden the tax base and ensure that income that might otherwise go undeclared or be difficult to track is captured at the point of payment. This significantly reduces the compliance burden on the individual payee while ensuring the government receives its due revenue in a timely manner.

- Entity: The primary entity overseeing and enforcing Withholding Tax in Kenya is the Kenya Revenue Authority (KRA). KRA is the central body responsible for the assessment, collection, and accounting of all revenues due to the government of Kenya.

- Relationship: The relationship created by WHT is tripartite:

- The Payer (Your Startup): You are legally obligated to deduct WHT from specific payments you make. You become an “agent” for KRA.

- The Payee (Recipient of Payment): This is the individual or entity providing the service or receiving the income from your startup (e.g., your landlord, consultant, or a service provider).

- The Kenya Revenue Authority (KRA): The ultimate beneficiary of the withheld tax, responsible for managing the tax system and ensuring compliance.

This system is crucial for KRA because it streamlines revenue collection, particularly from sectors where income might be irregular or difficult to trace. For example, a freelancer might have multiple clients, making it harder for KRA to track all their earnings. By having the client (your startup) withhold a small portion at source, KRA ensures it gets a share of that income.

In essence, Withholding Tax in Kenya is a proactive measure by KRA to ensure a more efficient and effective tax collection system, ultimately contributing to the nation’s revenue generation. It’s a small deduction at the point of payment that plays a big role in the national fiscal framework.

III. Why Withholding Tax Matters for Startups

For many startups, especially in their early stages, every shilling counts, and navigating compliance can feel like a distraction from core business activities. However, embracing and effectively managing Withholding Tax in Kenya is not just about avoiding penalties; it’s a strategic move that underpins your startup’s long-term viability and growth.

Here’s why WHT compliance is absolutely critical for your Kenyan startup:

Tax Compliance and Business Legitimacy

At its core, proper WHT management signals your startup’s commitment to operating legally and ethically. In Kenya’s business landscape, where integrity and adherence to regulations are increasingly valued, being tax compliant builds immediate credibility.

- Foundation for Trust: When you deal with suppliers, partners, or investors, demonstrating a clean tax record (which includes WHT) shows you are a responsible entity. This foundational trust is invaluable for building strong business relationships.

- A Hallmark of Professionalism: Just as you’d expect your partners to adhere to their obligations, demonstrating your own adherence to tax laws positions your startup as professional and reliable.

Avoiding Costly Penalties

This is perhaps the most immediate and impactful reason. The Kenya Revenue Authority (KRA) imposes strict penalties for non-compliance with WHT regulations. These penalties can quickly escalate and significantly drain your startup’s financial resources, which are often already stretched thin.

- Penalties for Late Filing: KRA charges a penalty of KES 20,000 or 5% of the tax due, whichever is higher, for failing to submit a WHT return by the due date.

- Penalties for Late Payment: On top of late filing penalties, there’s a penalty of 5% of the tax due for late payment.

- Interest Accrual: Unpaid WHT also attracts interest at a rate of 1% per month or part thereof. This means if you owe KES 100,000 in WHT and delay by three months, you could incur KES 15,000 in penalties plus KES 3,000 in interest (excluding daily interest calculations), quickly adding up!

These financial setbacks can severely impact your cash flow and ability to invest in growth initiatives.

Eligibility for Tenders and Investment Due Diligence

As your startup grows, you might eye larger contracts, government tenders, or seek external investment. In all these scenarios, a clean tax record, including consistent WHT compliance, is a non-negotiable requirement.

- Government and Corporate Tenders: Many tender pre-qualification processes require a valid Tax Compliance Certificate (TCC) from KRA. Any outstanding tax obligations, including WHT, can prevent you from obtaining or renewing your TCC, effectively barring you from lucrative opportunities.

- Investor Scrutiny: Angel investors, venture capitalists, and even banks conducting loan appraisals will perform rigorous financial due diligence. They look for red flags like non-compliance, which suggests poor financial management or potential hidden liabilities. A messy WHT history can be a significant deterrent to securing crucial funding. According to a 2023 report by the Kenya Private Equity and Venture Capital Association (KPEVCA), investor confidence is directly linked to robust financial governance and regulatory adherence.

Building a Credible Financial Reputation

In the long run, consistent tax compliance contributes significantly to your startup’s financial standing and reputation within the business community.

- Trust with Suppliers and Partners: When you consistently issue WHT certificates and handle deductions professionally, your suppliers and partners trust that their tax affairs are being handled correctly on their behalf, fostering stronger relationships.

- Easier Access to Services: From banking facilities to lines of credit, financial institutions are more willing to work with businesses that demonstrate a clear, transparent, and compliant financial history.

In conclusion, viewing Withholding Tax in Kenya as merely a regulatory burden is a shortsighted perspective. For a startup, mastering WHT is an investment in legitimacy, stability, and future growth. It’s about building a robust foundation that can withstand scrutiny and attract opportunities.

IV. When Does Withholding Tax Apply in Kenya?

Understanding when Withholding Tax in Kenya applies is crucial for any startup to ensure timely compliance and avoid surprises. It’s not about all payments your business makes, but rather specific types of payments for certain services or income streams. These are generally referred to as “trigger events” that activate your WHT obligation.

Trigger Events: Payments to Suppliers, Consultants, Landlords, and More

The obligation to deduct WHT arises the moment your startup makes a payment for a service or income category specifically designated by KRA as subject to WHT. This means before you transfer funds to the recipient, you must first calculate and set aside the WHT portion.

Some of the most common trigger events for Withholding Tax in Kenya that startups frequently encounter include:

- Paying Professional or Consultancy Fees: When your startup engages lawyers, auditors, marketing consultants, IT specialists, financial advisors, or any other professional service provider, WHT is likely applicable to their fees.

- Paying Commercial Rent: If your startup leases office space, a warehouse, or any other commercial property, the rent paid to your landlord is typically subject to WHT.

- Paying for Contractual Services: Certain specified contractual works, particularly in areas like construction or specialized services, can attract WHT.

- Distributing Dividends: If your startup has shareholders and decides to pay out dividends, a portion of these dividends must be withheld as tax.

- Paying Interest: While specific rules apply, certain types of interest payments (not typically interest on bank deposits for individuals) can be subject to WHT.

- Paying Royalties: If your startup uses patented technology, copyrighted material, or licensed intellectual property, the royalty payments made to the owner will incur WHT.

Taxable Transactions Overview

It’s important to differentiate between standard business expenses and those that fall under the WHT regime. Not every supplier payment requires WHT. For example, purchasing raw materials or office supplies from a general vendor typically does not attract WHT, as these are considered direct purchases of goods. WHT focuses more on payments for services rendered or income derived from specific passive income streams.

| Payment Type | Example Scenario for a Startup |

|---|---|

| Professional Fees | Paying your lawyer for company registration services. |

| Consultancy Fees | Paying an IT consultant for setting up your network. |

| Commercial Rent | Monthly rent payment for your office space in Westlands. |

| Contractual Fees | Paying a contractor to build out your office interior. |

| Dividends | Your startup pays out profits to its shareholders. |

| Royalties | Paying a software developer for the licensed use of their code. |

Export to Sheets

Entity Relationships: Payer (Startup) vs. Payee (Supplier/Consultant)

The applicability of Withholding Tax in Kenya hinges critically on the relationship between your startup (the Payer) and the recipient of the payment (the Payee).

- Payer’s Role: Your startup, as the payer, assumes the legal responsibility of a “tax agent.” This means you are obligated to:

- Determine if WHT applies to the payment.

- Calculate the correct WHT amount.

- Deduct the WHT from the gross payment.

- Remit the deducted WHT to KRA by the due date.

- Issue a WHT certificate to the payee (which they will use for their own tax compliance).

- Payee’s Role: The payee receives the net amount (gross payment minus WHT). The WHT deducted by your startup counts as an advance payment of their own income tax liability. They will use the WHT certificate to claim this credit when filing their annual tax returns, effectively reducing their final tax bill.

Case Study Snippet: “Marsha creatives“

Marsha creatives, a website development startup in Nairobi, needed legal advice for their intellectual property. They hired a local law firm for KES 150,000. Before remitting the payment, Marsha creatives lead, Jane, knew to deduct 5% WHT for professional fees, amounting to KES 7,500. She paid the law firm KES 142,500 and prepared to remit the KES 7,500 to KRA by the 20th of the following month, ensuring they stayed compliant.

This example highlights that the “when” of WHT is primarily tied to the act of making specific types of payments. Being aware of these trigger points is the first step towards seamless Withholding Tax in Kenya compliance.

V. Who Is Required to Deduct Withholding Tax?

A common question for many new entrepreneurs in Kenya is, “Does my startup need to deduct Withholding Tax in Kenya?” The answer is straightforward: If your startup makes any payment that is subject to WHT, you are legally required to deduct and remit that tax. There isn’t a separate application or registration process to become a “Withholding Tax Agent.” The act of making the WHT-applicable payment automatically designates you as such for that transaction.

Startups as Tax Agents

Under Kenyan tax law, any person or entity making a payment that falls under the categories subject to WHT is effectively appointed by the Kenya Revenue Authority (KRA) as a Withholding Tax Agent. This applies to:

- Individuals

- Companies (including your startup)

- Partnerships

- Societies

- Any other body of persons

This means your startup, regardless of its size, acts as a collection point for KRA. You are responsible for ensuring that the correct amount of tax is withheld from the payee’s income and then forwarded to the KRA. This role comes with significant legal obligations and accountability.

The Role of a Withholding Tax Agent:

As a WHT Agent, your startup is entrusted with public funds. Your responsibilities include:

- Identification: Correctly identifying which payments are subject to WHT.

- Calculation: Accurately calculating the WHT amount based on the correct rate and the gross payment.

- Deduction: Withholding the calculated tax from the payment to the payee.

- Remittance: Paying the deducted WHT to KRA by the stipulated deadline.

- Documentation: Maintaining accurate records and issuing WHT certificates to payees.

Thresholds for Responsibility

Unlike some other tax obligations which might have minimum turnover thresholds (e.g., VAT registration), the requirement to deduct Withholding Tax in Kenya typically does not have a monetary threshold for the payer. If a payment is of a nature subject to WHT, the obligation to deduct arises, regardless of the amount.

For example, if HostKenya pay a resident lawyer KES 5,000 for a quick consultation that is subject to 5% WHT, It is obligated to deduct KES 250 and remit it to KRA. It’s not about the size of Company or the size of the payment, but the type of payment.

However, it’s worth noting that some specific WHT categories may have minor exceptions or unique rules for very small amounts, but these are rare and don’t negate the general principle. Always assume WHT applies to the designated payment types unless explicitly stated otherwise by KRA.

Entity Relationships: Tax Agent Startup → KRA → Payee

To illustrate this chain of responsibility:

- Your Startup (Tax Agent): Initiates the payment for a WHT-applicable service/income. Before paying the full amount, your startup deducts the WHT.

- Kenya Revenue Authority (KRA): Is the ultimate recipient of the withheld tax. Your startup remits the collected WHT directly to KRA. KRA then credits this amount to the payee’s tax account.

- The Payee: Receives the net amount (gross payment minus WHT). They then use the WHT certificate issued by your startup to prove that tax has already been paid on their behalf, which offsets their final income tax liability.

Example Scenario: HostKenya Web Solutions

HostKenya, a Nairobi-based web hosting startup, hires a freelance designer for a one-time project. Since design is a professional service, HostKenya must deduct 5% withholding tax from the payment and remit it to KRA—making them a withholding tax agent for that transaction, even as a small business.

Understanding this fundamental principle – that your startup automatically assumes the role of a WHT agent for specific payments – is key to proactive Withholding Tax in Kenya compliance. It removes any ambiguity about who needs to act.

VI. Which Payments Attract Withholding Tax in Kenya?

Understanding the specific types of payments that attract Withholding Tax in Kenya is paramount for any startup. It’s not a one-size-fits-all approach; different types of income and services have distinct WHT obligations and rates. Misclassifying a payment can lead to under-deduction, resulting in penalties, or over-deduction, causing unnecessary strain on your supplier relationships.

Here’s a detailed breakdown of the most common payment categories subject to WHT in Kenya:

A. Professional and Consultancy Fees

This is one of the most frequently encountered WHT categories for startups that outsource specialized tasks.

- Entities: This applies to payments made to resident individuals or firms offering professional services. This broad category includes:

- Lawyers and legal consultants

- Auditors and accountants

- Management consultants

- IT consultants and software developers (for certain services)

- Architects, engineers, quantity surveyors

- Marketing and branding consultants

- Financial advisors

- Rate: For residents, the WHT rate on professional and consultancy fees is 5%.

- Deep Dive: It’s important to distinguish between payments for professional services and payments for goods. For instance, if you’re paying an IT consultant to set up your server, that’s a professional service. If you’re buying server equipment from them, that’s a purchase of goods, typically not subject to WHT (unless it’s a specific supply contract as defined by KRA). The key is the nature of the engagement.

B. Rent (Commercial)

If your startup operates from a rented premise, this WHT applies.

- Entities: This applies to payments made by tenants (your startup) to landlords (individuals or companies) for the use of commercial property.

- Rate: For commercial rent paid to a resident landlord, the WHT rate is 10%.

- Important Distinction: This specifically refers to commercial rent. Residential rent paid by an individual tenant for their home is generally not subject to WHT. Ensure you’re clear on the classification of the rented property. This is a common area of confusion for new businesses.

C. Dividends, Interest, and Royalties

These categories often apply as your startup grows, attracts investment, or develops intellectual property.

1. Dividends

- Entities: Payments made by a company (your startup) to its shareholders from its profits.

- Rate: For resident individuals or companies, the WHT rate on dividends is 5%. Non-residents face a higher rate, often 10%, unless a Double Taxation Treaty provides a lower rate (see Section XII).

- Fact: The purpose of WHT on dividends is to tax the income received by shareholders at the point of distribution, before they receive the net amount.

2. Interest

- Entities: Payments made for the use of borrowed money. This includes interest on loans, advances, or deposits.

- Rate: For residents, the general WHT rate on interest is 15%. Non-residents face a higher rate, usually 15% or 20%, but this can be reduced by a DTT.

- Important Note: Interest paid by a financial institution (like a bank) to a resident individual on normal savings accounts is typically exempt from WHT if below certain thresholds, or taxed at final withholding tax rates. However, interest paid by your startup on a loan from an individual or another company would typically be subject to WHT.

3. Royalties

- Entities: Payments for the use of intellectual property, such as patents, copyrights, trademarks, franchises, designs, or secret processes.

- Rate: For residents, the WHT rate on royalties is 5%. For non-residents, the rate is generally 20%, subject to DTT relief.

- Example: If your startup uses a specific software platform under license and pays a recurring fee for its intellectual property rights, that fee might be classified as a royalty payment.

D. Management and Contractual Fees

These often relate to outsourced operational functions or specific projects.

- Entities: Payments for management services, supervision fees, or fees for certain types of contractual work.

- Rate: For residents, the WHT rate on management and contractual fees is generally 5%. For non-residents, the rate is typically 20%, subject to DTTs.

- Deep Dive: The distinction between a “professional fee” and a “management/contractual fee” can sometimes be subtle. KRA typically defines professional fees as those requiring specialized intellectual skills (e.g., legal, accounting), while management fees cover the overall running or supervision of a business or project. When in doubt, it’s best to consult KRA’s specific definitions or a tax professional.

E. Other Withholding Taxes

Beyond the common categories, a few other payments also attract WHT:

- Gaming and Betting Winnings: Any winnings from gaming and betting activities are subject to WHT at a rate of 20%. This is typically deducted by the betting firm before payout.

- Payments to Non-Residents: This is a broad and significant category. Many payments made to individuals or companies not resident in Kenya are subject to higher WHT rates, often ranging from 15% to 20%, depending on the type of income. This is crucial for startups engaging international talent or service providers. The specific rate is highly dependent on whether a Double Taxation Treaty exists between Kenya and the payee’s country of residence. Without a DTT, KRA’s standard non-resident rates apply, which are generally higher.

Key Takeaway for Startups: The nature of the service or income, and the residency status of the recipient, are the two primary factors determining if and what rate of Withholding Tax in Kenya applies. A good rule of thumb is to always consider WHT when paying for services rather than just goods, especially when dealing with professionals, landlords, or any international entities.

VII. What Are the Current Withholding Tax Rates in Kenya?

Navigating the landscape of Withholding Tax in Kenya requires a clear understanding of the applicable rates. These rates are not uniform; they vary significantly based on two primary factors: the nature of the payment and the residency status of the payee. For a startup, accurately applying these rates is crucial to avoid under-deductions (leading to KRA penalties) or over-deductions (potentially straining relationships with your service providers).

The table below summarizes the key WHT rates your Kenyan startup is most likely to encounter. Remember that these rates are subject to change based on new finance acts or government policies. Always refer to the latest KRA guidelines or consult a tax professional for the most current information.

Table of WHT Rates (Residents vs. Non-Residents)

| Income Type | Resident Rate | Non-Resident Rate (General) | Applicable Entities | Key Considerations for Your Startup |

|---|---|---|---|---|

| Dividends | 5% | 10% (can be 5% if DTT applies) | Shareholders, KRA, Payees (Shareholders) | Applies when your startup distributes profits. Check DTT for foreign shareholders. |

| Interest | 15% | 15% / 20% (can be lower if DTT applies) | Individuals, Companies, KRA, Payees (Lenders) | For interest on loans from individuals or other businesses (not typically bank deposits). |

| Royalties | 5% | 20% (can be lower if DTT applies) | IP Holders, KRA, Payees (IP Licensors) | For licensed use of intellectual property (e.g., software, brand names). |

| Professional Fees | 5% | 20% (can be lower if DTT applies) | Lawyers, Auditors, Consultants, KRA, Payees (Professionals) | Very common for startups engaging legal, accounting, IT, or marketing services. |

| Management Fees | 5% | 20% (can be lower if DTT applies) | Management Companies, KRA, Payees (Service Providers) | For outsourced management or oversight services. |

| Contractual Fees | 5% | 20% (can be lower if DTT applies) | Contractors, KRA, Payees (Service Providers) | For specific services like construction, specialized installations. |

| Rent (Commercial) | 10% | 30% | Landlords, KRA, Payees (Landlords) | If your startup rents commercial office or operational space. |

| Gaming & Betting Winnings | 20% | 20% | Winners, Betting Companies, KRA, Payees (Winners) | Less common for startups, but relevant if your business involves payouts. |

Export to Sheets

Important Considerations for Startups:

- Nature of Service: The exact definition of each category is crucial. A “consultancy fee” might technically fall under “professional fees” but understanding KRA’s specific classification for various services is key.

- Residency Status: This is a major determinant of the WHT rate. A “resident” in Kenya is generally an individual who lives in Kenya for a certain period, or a company incorporated in Kenya or managed and controlled from Kenya. A “non-resident” is anyone or any entity that doesn’t meet the resident criteria.

- Pro Tip: Always confirm the KRA PIN of your Kenyan suppliers to ascertain their resident status. For non-residents, request proof of their country of residence.

- Double Taxation Treaties (DTTs): For payments to non-residents, always check if Kenya has a DTT with the payee’s country of residence. These treaties are designed to prevent the same income from being taxed twice and often prescribe lower WHT rates than KRA’s general non-resident rates. (We’ll cover DTTs in more detail in Section XII).

- KRA (Kenya Revenue Authority): Is the central body defining and enforcing these rates. Their official publications and iTax platform are the definitive sources for current information.

- Payees: The individuals or entities from whom you deduct the WHT. They will use the WHT certificate you provide to claim a credit against their tax liability.

Example: A Tale of Two Consultants

Consider “EcoFarm Tech,” a Kenyan agritech startup. They hire a resident agricultural consultant for a project, incurring KES 80,000 in professional fees. EcoFarm Tech will deduct 5% WHT (KES 4,000) and pay the consultant KES 76,000.

A few months later, EcoFarm Tech engages an international data analyst from the USA for a specialized algorithm, costing KES 150,000. Assuming no specific DTT provision is invoked for this service, EcoFarm Tech would generally deduct 20% WHT (KES 30,000) and pay the analyst KES 120,000. This stark difference highlights the impact of residency and DTTs.

Understanding these rates and their nuances is fundamental to effective Withholding Tax in Kenya management and ensures your startup remains fully compliant with KRA requirements.

VIII. How to Deduct and Pay Withholding Tax in Kenya

Once you’ve determined that a payment attracts Withholding Tax in Kenya and you know the correct rate, the next crucial step is the actual process of deduction, filing, and remittance. This process primarily takes place through the Kenya Revenue Authority’s (KRA) online portal, iTax. Mastering these steps ensures your startup remains compliant and avoids any last-minute rushes or errors.

Here’s a step-by-step guide for deducting, filing, and paying WHT:

Steps to Deduct WHT Before Payment

This is the very first action you must take before releasing the full payment to your payee.

- Verify the Gross Payment: Confirm the total amount due to your supplier, consultant, or landlord before any deductions. This is your “gross” payment.

- Identify the WHT Rate: Refer to the table in Section VII and KRA’s current guidelines to determine the exact Withholding Tax in Kenya rate applicable to that specific type of income and the payee’s residency status.

- Calculate the WHT Amount: Multiply the gross payment by the applicable WHT rate.

- Formula:

WHT Amount = Gross Payment × WHT Rate - Example: If you owe KES 50,000 for professional services at a 5% WHT rate:

WHT Amount = KES 50,000 × 0.05 = KES 2,500.

- Formula:

- Pay the Net Amount to Payee: Deduct the calculated WHT amount from the gross payment. The remaining amount is what you pay to the payee.

- Formula:

Net Payment to Payee = Gross Payment - WHT Amount - Example: You would pay the professional KES 47,500 (KES 50,000 – KES 2,500).

- Formula:

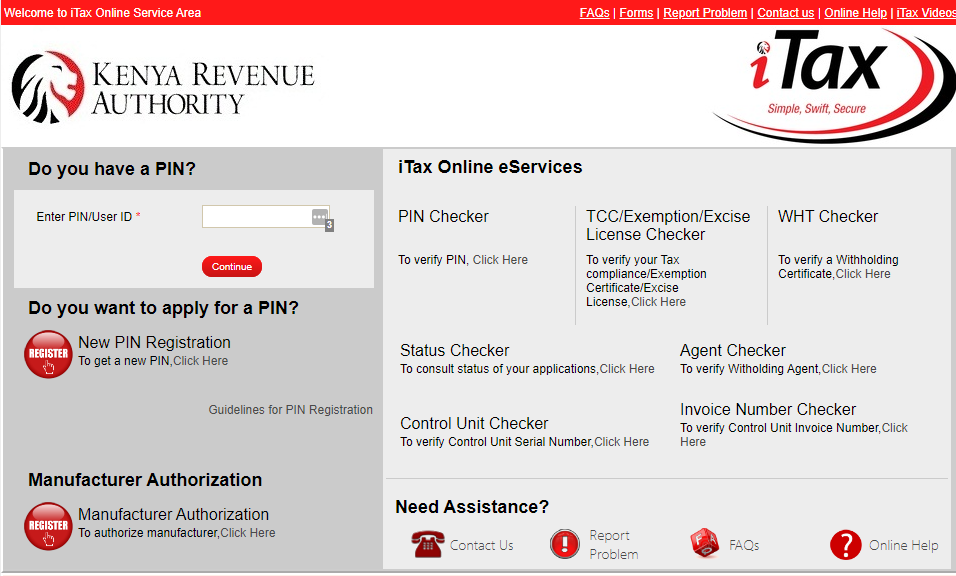

How to File on iTax

The filing of your WHT return is done online via the KRA iTax platform.

- Log in to iTax: Go to the official KRA iTax portal (https://itax.kra.go.ke/KRA-Portal/) and log in using your startup’s KRA PIN and password.

- Navigate to Payments: From the main menu, click on “Payments” then select “Payment Registration.”

- Initiate Payment Registration:

- Tax Head: Select “Income Tax.”

- Sub-Tax Head: Select “Withholding Tax.”

- Payment Type: Choose “Self-Assessment” (unless instructed otherwise for specific scenarios).

- Tax Period: Enter the month and year the WHT was deducted (e.g., if you deducted WHT in May 2025, the tax period would be May 2025).

- Add Obligation: Click “Add Obligation” and select “Income Tax – Withholding Tax.”

- Enter Transaction Details: This is where you input the specifics of each WHT transaction. You will need:

- Payee’s KRA PIN: Ensure this is correct.

- Payee’s Name: Autopopulated once PIN is entered.

- Income Type: Select the specific WHT category (e.g., Professional Fees, Rent, Dividends).

- Gross Amount Paid: The total amount before WHT deduction.

- Withholding Tax Rate: The percentage applied.

- Withholding Tax Amount: The amount you calculated and deducted.

- Date of Payment: The date you made the payment to the payee.

- You can add multiple transactions if you withheld WHT from several payees during the month.

- Submit and Generate Payment Slip (PRN): After entering all details, review for accuracy. Once satisfied, click “Submit.” The system will generate a Payment Registration Number (PRN). This PRN is vital as it’s the unique identifier for your payment.

Generating Payment Slips and Remittance

Once you have your PRN, you can proceed to pay the WHT.

- Print or Save PRN: It’s advisable to print or save the PRN document generated by iTax. It contains details like the amount due, the KRA bank account, and the unique PRN.

- Remit Payment: You can pay the WHT using one of the following methods:

- Bank Deposit: Take the PRN to any KRA-appointed commercial bank (e.g., KCB, Equity Bank, NCBA, Stanbic). Inform the teller you are paying KRA taxes and provide the PRN. They will process the payment.

- Mobile Banking (M-Pesa): Most banks have integrated M-Pesa paybill numbers for KRA payments. You would typically use the bank’s KRA paybill number and the PRN as the account number.

- Example (via M-Pesa): Go to M-Pesa menu > Lipa na M-Pesa > Pay Bill > Enter Business No. (e.g., your bank’s KRA Paybill) > Enter Account No. (the PRN) > Enter Amount > Enter M-Pesa PIN.

- Online Banking: Many banks offer online platforms where you can make KRA payments directly by entering the PRN.

Proof of Payment: WHT Certificates

While not part of the payment process, issuing a Withholding Tax Certificate is a crucial follow-up step.

- Purpose: This certificate serves as official proof to the payee that you, as the payer, have deducted and remitted WHT on their behalf. The payee needs this certificate to claim the WHT as a tax credit when they file their own annual income tax returns, reducing their final tax bill.

- Generation: You can generate WHT certificates directly from the iTax portal after successful remittance. Go to “Certificates” > “Withholding Certificate.” Select the payee and the relevant period, and the system will generate the certificate.

- Distribution: Ensure you provide a copy of this certificate to your payee. Many businesses require this certificate as part of their own financial record-keeping.

Entities Involved:

- KRA: The ultimate authority and recipient of the tax.

- iTax System: The online portal for filing returns and generating payment slips.

- Commercial Banks: The payment channels for remitting the tax.

By diligently following these steps, your startup can efficiently manage its Withholding Tax in Kenya obligations, ensuring seamless compliance and good standing with the tax authorities.

IX. Withholding Tax Compliance Requirements and Timelines

Beyond simply knowing how to deduct and pay Withholding Tax in Kenya, your startup must also master the when and what of ongoing compliance. KRA has strict deadlines and record-keeping expectations, and missing these can quickly lead to penalties, even if you’ve correctly calculated the tax.

Monthly Filing Deadlines

The most critical timeline for Withholding Tax in Kenya is its monthly remittance schedule.

- Due Date: All WHT deducted from payments made in a particular month must be filed and paid to KRA by the 20th day of the following month.

- Example: If your startup paid professional fees on May 15, 2025, and deducted WHT, that WHT amount must be remitted to KRA by June 20, 2025.

- Weekend/Holiday Rule: If the 20th falls on a weekend or a public holiday in Kenya, the deadline automatically shifts to the last working day before the 20th. For instance, if June 20th is a Saturday, the deadline would be Friday, June 19th. Always double-check the calendar!

- Strict Adherence: KRA is very strict with these deadlines. The iTax system automatically flags late submissions, and penalties accrue immediately.

Records to Keep

Maintaining meticulous records is not just good business practice; it’s a mandatory compliance requirement for Withholding Tax in Kenya. These records serve as your proof of compliance during KRA audits and help in resolving any discrepancies.

Your startup should keep detailed records of:

- Invoices and Payment Vouchers: For every payment made where WHT was applicable. These should clearly show the gross amount, the WHT deducted, and the net amount paid.

- WHT Calculation Sheets: Simple internal documents showing how you arrived at the WHT amount for each transaction. This can be an Excel sheet.

- KRA Payment Slips (PRNs): Keep digital and/or physical copies of every PRN generated on iTax for WHT remittances. These are your undeniable proof of payment to KRA.

- Bank Statements: Cross-reference your WHT payments with your bank statements to confirm the actual remittance.

- WHT Certificates Issued: Maintain copies of all Withholding Tax in Kenya certificates you issue to your payees. This proves you facilitated their tax credit.

- Payee KRA PINs: Always ensure you have the correct KRA Personal Identification Number (PIN) for every payee from whom you deduct WHT. This is essential for accurate filing on iTax.

Audits and Cross-Checks

The Kenya Revenue Authority (KRA) doesn’t just rely on your self-declarations. They regularly conduct compliance checks and audits, and Withholding Tax in Kenya is a prime area of focus.

- Data Matching: KRA’s iTax system is designed to perform sophisticated cross-checks. For example, they can compare:

- The WHT you declared as deducted from a specific supplier with the income that supplier declared in their own tax returns.

- Your expense records against WHT remittances.

- Your bank payments against declared WHT.

- Supplier Reconciliation: If a supplier from whom you’ve withheld tax is undergoing an audit, KRA will likely request proof of WHT deduction from them (your WHT certificate). If your records don’t match or you failed to remit, both your startup and the supplier could face issues.

- Consequences of Discrepancies: Any inconsistencies or gaps in your WHT records can trigger a full tax audit of your startup, leading to significant time investment, potential penalties, and reputational damage.

Relationships:

- Startup ↔ KRA: Your direct reporting and payment obligation to the tax authority.

- Startup ↔ Bank Statements: Financial records proving actual remittance.

- Startup ↔ Suppliers: Your relationship is based on accurate deductions and the provision of WHT certificates. Suppliers depend on your compliance for their own tax credits.

In summary, effective Withholding Tax in Kenya compliance goes beyond just deducting the right amount. It encompasses a disciplined approach to monthly deadlines, meticulous record-keeping, and an understanding that KRA actively cross-references data. Proactive management in these areas will safeguard your startup’s financial health and standing with the tax authorities.

X. What Happens If You Don’t Comply? (Penalties and Risks)

While the previous sections have focused on how to comply with Withholding Tax in Kenya, it’s equally vital for your startup to understand the severe repercussions of non-compliance. Neglecting your WHT obligations isn’t just a minor oversight; it can lead to significant financial penalties, legal complications, and severe damage to your business’s reputation and operational viability.

KRA takes Withholding Tax in Kenya very seriously because you, as the withholding agent, are holding government revenue in trust. Failure to deduct or remit this tax is treated as a direct failure to remit public funds.

Penalties for Late Filing or Payment

The most immediate and common consequence of non-compliance is the imposition of financial penalties and interest by KRA. These can quickly accumulate, turning a small oversight into a substantial liability.

- Penalty for Late Filing of a WHT Return: If your startup fails to submit its monthly WHT return (even if no tax was due for that month, or if you simply didn’t file on time), KRA imposes a penalty of KES 20,000 or 5% of the tax due, whichever is higher.

- Example: If you had KES 50,000 in WHT to remit and failed to file by the 20th, you would face a KES 20,000 penalty (since 20,000 is higher than 5% of 50,000, which is KES 2,500).

- Penalty for Late Payment of WHT: If you file the return but fail to pay the deducted WHT by the due date, KRA imposes a penalty of 5% of the tax due. This is in addition to the late filing penalty if the return itself was also late.

- Interest Accrual: Beyond the fixed penalties, KRA charges interest on any unpaid Withholding Tax in Kenya. The interest rate is 1% per month or part thereof. This means interest starts accruing from the day after the deadline until the tax is fully paid.

- Illustration: Imagine your startup deducted KES 100,000 in WHT in May 2025, due by June 20, 2025. If you only remit it on August 25, 2025:

- Late Filing Penalty: KES 20,000 (assuming you didn’t file the return).

- Late Payment Penalty: KES 5,000 (5% of KES 100,000).

- Interest: KES 3,000 (1% for June 21 – July 20, 1% for July 21 – August 20, and 1% for August 21 – August 25, rounding up to 3 months).

- Total extra cost: KES 28,000 in just over two months, on top of the original KES 100,000!

- Illustration: Imagine your startup deducted KES 100,000 in WHT in May 2025, due by June 20, 2025. If you only remit it on August 25, 2025:

Audit Risk and KRA Enforcement

Non-compliance significantly elevates your startup’s risk of being audited by KRA.

- Increased Scrutiny: KRA’s iTax system is sophisticated and can easily flag inconsistencies, such as payments made to suppliers for which no WHT was remitted, or discrepancies between your declared expenses and your WHT filings. These flags often lead to audit notices.

- Time and Resource Drain: A KRA audit is a time-consuming and often stressful process. It diverts valuable management and finance team resources away from core business operations. You’ll need to gather extensive documentation, respond to KRA queries, and potentially attend meetings.

- Discovery of Other Issues: An audit for WHT non-compliance can often lead to the discovery of other tax non-compliance issues within your startup, expanding the scope of the audit and potentially increasing overall liabilities.

Effect on Business Licenses, Tenders, and Funding

Beyond direct financial penalties, non-compliance with Withholding Tax in Kenya can cripple your startup’s ability to operate and grow.

- Business Licenses: Many local and national business licenses require you to be tax compliant. Outstanding tax arrears or a history of non-compliance can prevent you from obtaining or renewing critical operating licenses.

- Government and Private Tenders: As mentioned before, a valid Tax Compliance Certificate (TCC) is a mandatory requirement for bidding on almost all government tenders and a significant number of private sector tenders. KRA will not issue a TCC if your startup has outstanding tax obligations, including unremitted WHT. This can effectively lock your business out of major growth opportunities.

- Funding and Investment: Investors, whether angel investors, venture capitalists, or even banks considering loans, perform extensive due diligence. A history of tax non-compliance is a major red flag. It indicates poor financial management, potential hidden liabilities, and a lack of understanding of regulatory environments. This can deter potential funders, making it difficult to secure the capital needed for expansion.

Reputational Damage

In the long term, a poor tax compliance record can damage your startup’s reputation in the market.

- Loss of Trust: Suppliers, partners, and even customers might lose trust in your business if they learn of your non-compliance, viewing it as unreliable or unethical.

- Negative Public Image: In severe cases, significant tax evasion can lead to negative media attention, harming your brand image and making it harder to attract talent or customers.

In essence, while the immediate focus for startups is often growth and survival, diligent management of Withholding Tax in Kenya is a fundamental pillar of sustainable success. The risks of non-compliance far outweigh the perceived convenience of neglecting these obligations. It’s an investment in your startup’s future stability and credibility.

XI. Are There Exemptions from Withholding Tax?

While Withholding Tax in Kenya has broad applicability, it’s not a universal rule for every payment. There are specific circumstances and types of entities that may be exempt from having WHT deducted, or for which the requirement to withhold simply doesn’t apply. Understanding these exemptions can help your startup accurately assess its obligations and avoid unnecessary deductions.

It’s crucial to note that exemptions are usually explicitly stated by KRA and should be verified with caution. When in doubt, it’s always safer to withhold and remit, or to seek professional advice.\

Small Transactions and Threshold Exemptions

Generally, for most common WHT categories like professional fees or rent, there isn’t a de minimis (too small to bother with) monetary threshold that automatically exempts a payment from Withholding Tax in Kenya. If a payment is of a nature that attracts WHT, the obligation to deduct arises, even for relatively small amounts.

However, specific types of income or transactions might have their own unique thresholds or conditions for exemption:

- Interest Income: Certain types of interest, particularly from bank deposits for resident individuals, might be exempt from WHT if the annual interest earned is below a specified threshold, or is taxed as a final withholding tax, meaning the payee does not need to declare it further. For instance, interest on savings accounts below a certain limit might be exempt or subject to a final WHT.

- Specific Minor Payments: In very rare and specific cases, KRA might issue circulars or clarifications on certain minor payments that do not necessitate WHT. However, these are exceptions, not the rule. Always confirm directly with KRA for such specific cases.

Tax Exemption Certificates

This is a significant category of exemption for Withholding Tax in Kenya. Certain organizations or individuals may be granted tax exemption status by KRA, meaning that any income they receive is exempt from various taxes, including WHT.

- Entities: This usually applies to:

- Charitable organizations and Non-Governmental Organizations (NGOs): Many registered charities and NGOs in Kenya are granted tax-exempt status by KRA under the Income Tax Act.

- Religious institutions: Churches, mosques, and other registered religious bodies often hold tax-exempt status.

- Certain public bodies: Specific government agencies or parastatals might also be exempt.

- How it Works: If your startup is making a WHT-applicable payment to an entity that claims exemption, they must provide you with a valid Tax Exemption Certificate issued by KRA. It is your responsibility as the withholding agent to request and verify this certificate. You should keep a copy of this certificate in your records to justify why you did not deduct WHT.

- Important: Without a valid, current Tax Exemption Certificate, you are still obligated to deduct WHT, even if the entity claims to be exempt. Do not rely on verbal assurances.

Startups Under Certain Incubators/NGOs

While not a broad exemption for Withholding Tax in Kenya generally, there might be very specific, limited scenarios where startups operating under certain KRA-approved incubators, special economic zones, or non-governmental programs could benefit from tailored tax incentives or reliefs.

- Specific Programs: These are usually highly targeted incentives aimed at promoting specific industries or development goals. For example, a startup operating within a designated Special Economic Zone (SEZ) might be eligible for certain tax breaks, which could indirectly affect WHT on specific transactions.

- Verification is Key: If your startup believes it falls under such a specific program, you must obtain clear documentation from KRA or the relevant government body confirming any WHT exemption or reduction. Do not assume. These are typically not general exemptions but rather specific agreements or gazetted rules.

Key Entities Involved in Exemptions:

- KRA: The sole authority for granting tax exemptions and issuing exemption certificates.

- Exempt Organizations: The recipients of payments who hold valid KRA tax exemption certificates.

- Your Startup: The payer who must verify and keep records of these exemptions.

Case Study Snippet: “GreenHarvest Agri”

GreenHarvest Agri, a Nairobi-based startup, partnered with a local NGO, “Rural Empowerment Foundation,” to train farmers. The NGO charged GreenHarvest a management fee for coordinating the training. Upon requesting their KRA PIN, GreenHarvest also asked for any tax exemption certificates. The NGO promptly provided a valid KRA Tax Exemption Certificate. Based on this, GreenHarvest correctly determined that they were not required to deduct Withholding Tax in Kenya from the payment to the NGO, as the NGO was exempt from income tax.

Understanding these limited exemptions ensures your startup avoids unnecessary WHT deductions and maintains proper compliance, but always remember that the burden of proof for an exemption lies with the payee providing a valid certificate.

XII. Withholding Tax and Double Taxation Treaties

In an increasingly globalized business environment, many Kenyan startups are extending their reach beyond national borders. You might engage international consultants, license foreign software, or even have non-resident shareholders. When making payments across borders, understanding how Withholding Tax in Kenya interacts with Double Taxation Treaties (DTTs) becomes incredibly important.

Effect on Foreign Payments

A Double Taxation Treaty (also known as a Double Taxation Agreement or DTA) is a bilateral agreement between two countries to prevent the same income from being taxed twice – once in the country where the income originates (source country) and once in the country where the recipient is resident.

For your startup in Kenya, this means that when you make a WHT-applicable payment to a non-resident individual or company, the general higher non-resident WHT rates (as seen in Section VII) might be reduced or even eliminated if Kenya has a DTT with the payee’s country of residence.

- Preventing Double Taxation: Without a DTT, a non-resident consultant, for example, might have their fee taxed by Kenya (through WHT) and then again by their home country’s tax authority. DTTs provide a mechanism to either exempt the income in one country or provide a credit for the tax paid in the other.

- Reduced WHT Rates: A key provision in many DTTs is the reduction of Withholding Tax in Kenya on specific types of passive income like dividends, interest, and royalties, and sometimes even professional or management fees. For instance, the general non-resident WHT rate for royalties might be 20%, but a DTT could reduce it to 10% or even 5%.

Relief for Startups with International Partners

For Kenyan startups, DTTs offer significant relief by:

- Lowering Costs: Reduced WHT rates mean that your non-resident partners receive more of their gross payment, making your startup a more attractive client or partner. This can be a competitive advantage when sourcing international talent or services.

- Facilitating International Engagement: By simplifying the tax implications, DTTs encourage cross-border trade, investment, and collaboration, which is vital for startups looking to scale globally or leverage international expertise.

- Ensuring Compliance: While it adds a layer of complexity, correctly applying DTT rates ensures you are compliant with both Kenyan tax law and international tax agreements.

Countries with Treaties

Kenya has a growing network of Double Taxation Treaties. Some of the countries with which Kenya has active DTTs include:

- United Kingdom

- Germany

- India

- South Africa

- Mauritius

- United Arab Emirates

- Norway

- Sweden

- Denmark

- Finland

- France

- Canada

- Zambia

- Iran

- China

- Korea

- Qatar

This list is not exhaustive and is subject to change. Always verify the current status of a DTT and its specific provisions with KRA or a tax expert.

How to Apply Reduced Rates

Applying a DTT reduced rate for Withholding Tax in Kenya is not automatic and requires specific steps and documentation from your startup:

- Verify Treaty Existence and Provisions: Confirm that a DTT exists between Kenya and the payee’s country of residence, and specifically check the article related to the type of income being paid (e.g., Article on Royalties, Article on Professional Services). This article will specify the maximum WHT rate allowed under the treaty.

- Obtain a Tax Residency Certificate (TRC): The non-resident payee must provide your startup with a valid Tax Residency Certificate issued by their country’s tax authority. This document proves they are a tax resident of that treaty country. This is mandatory documentation for KRA.

- Submit Application (Optional but Recommended): While not always explicitly required for every single payment, for larger or ongoing payments, it’s advisable to seek advance clearance from KRA if you intend to apply a DTT rate. This can be done by submitting an application to KRA with the TRC and details of the transaction.

- Deduct the Treaty Rate: Once you have the TRC and are confident of the treaty’s applicability, you can deduct the lower WHT rate as specified in the DTT.

- Record Keeping: Maintain meticulous records of the TRC, the DTT article relied upon, your calculations, and correspondence with the payee. This will be crucial during any KRA audit.

- iTax Declaration: When filing your WHT return on iTax, ensure you correctly indicate that a DTT rate has been applied and be prepared to provide the necessary supporting documentation if requested by KRA.

Illustrative Example: “GlobalConnect Solutions”

GlobalConnect Solutions, a Kenyan startup, licenses a critical piece of software from a company in Germany. The general non-resident WHT rate for royalties in Kenya is 20%. However, Kenya has a DTT with Germany that specifies a maximum WHT rate of 10% on royalties. GlobalConnect requests and receives a Tax Residency Certificate from the German company. Based on this, GlobalConnect deducts only 10% WHT from the royalty payment instead of 20%, saving the German company money and strengthening their partnership, all while remaining compliant with Withholding Tax in Kenya under the DTT.

Navigating DTTs can be complex, and any misapplication can lead to KRA challenging the lower rate and demanding the difference plus penalties. For significant international transactions, it is always advisable to consult with a tax professional specializing in international taxation to ensure correct application of DTTs.

XIII. Common Challenges Startups Face with Withholding Tax

Even with the best intentions, complying with Withholding Tax in Kenya can present several practical hurdles for startups. Unlike larger, established corporations with dedicated finance departments, startups often operate with lean teams and limited resources, making complex compliance tasks more challenging. Recognizing these common pitfalls is the first step toward overcoming them.

Here are some of the key challenges Kenyan startups frequently face with WHT:

Cash Flow Impact

This is arguably one of the most immediate and significant challenges for many startups.

- Temporary Strain: When your startup deducts WHT, it means you’re paying less to your supplier now, but that deducted amount still needs to be remitted to KRA by the 20th of the following month. This creates a temporary holding of funds that, for a cash-strapped startup, can feel like a drain on working capital.

- Budgeting Oversight: Some startups might not adequately budget for the WHT remittance, especially if their revenue comes in unevenly. They might spend the gross amount received, only to find themselves short when the WHT payment deadline approaches.

- Fact: Many small businesses fail due to poor cash flow management, not necessarily lack of profitability. WHT, if mismanaged, can exacerbate this.

Complexity of Different Rates

As seen in Section VII, Withholding Tax in Kenya is not a flat rate. The varying rates based on income type and payee residency can be a source of confusion.

- Misclassification Risk: Startups might accidentally apply the wrong rate to a payment (e.g., applying 5% for professional fees to a non-resident, instead of 20%, or vice-versa). This leads to incorrect deductions.

- Residency Ambiguity: Determining whether a payee is a “resident” or “non-resident” can sometimes be tricky, especially with global remote teams or evolving business structures. This impacts the applicable WHT rate, and getting it wrong can lead to penalties.

- Double Taxation Treaty (DTT) Nuances: While DTTs offer benefits, correctly applying them requires understanding specific treaty articles and obtaining valid Tax Residency Certificates, adding a layer of complexity that many startups are not equipped to handle without external help.

Lack of In-House Tax Expertise

Most early-stage startups cannot afford a dedicated in-house tax specialist or even a full-time accountant with deep tax knowledge.

- Reliance on Generalists: Finance roles are often handled by founders themselves, an office administrator, or a generalist accountant who might have limited exposure to the specific nuances of Withholding Tax in Kenya.

- Knowledge Gaps: This lack of specialized expertise can lead to missed obligations, incorrect calculations, or a complete unawareness of WHT applicability until an audit arises.

- Keeping Up with Changes: Tax laws, including WHT rates and rules, can change annually (e.g., through the Finance Act). Without dedicated monitoring, startups can easily fall behind.

Mistakes in Filing and Classification

Even if a startup understands the theory of WHT, practical errors during the iTax filing process are common.

- iTax Portal Challenges: While iTax has improved, navigating the portal, correctly selecting income types, and accurately inputting payee details can still be challenging for those unfamiliar with it. Errors can lead to invalid PRNs or incorrect credit allocation to the payee.

- Manual Errors: If using manual spreadsheets for tracking, data entry errors in calculation or payee details are highly possible.

- Misclassification in Returns: Even if the deduction was correct, classifying the income type incorrectly on the iTax return can lead to reconciliation issues for KRA.

Administrative Burden

The entire process of tracking, deducting, filing, remitting, and issuing certificates for Withholding Tax in Kenya adds to the administrative load of a lean startup.

- Time Consuming: For every WHT-applicable payment, there are multiple steps involved, from calculation and deduction to iTax filing and certificate generation. For a startup with many such transactions, this can consume significant operational time.

- Documentation Management: Keeping all the necessary invoices, payment proofs, PRNs, and WHT certificates organized for potential KRA audits requires diligent record-keeping systems.

Case Study Snippet: “FikaFast Deliveries”

FikaFast Deliveries, a rapidly expanding logistics startup, faced a challenge. They had multiple freelance delivery riders who also provided “consultancy” on route optimization for their tech team, in addition to their delivery services. FikaFast’s internal accounts assistant struggled to differentiate between the WHT applicable to professional consultancy fees versus the non-WHT applicable delivery service payments. This led to under-deductions on some payments and confusion about the correct WHT rates, eventually resulting in a KRA penalty due to discrepancies.

These challenges underscore the need for Kenyan startups to develop robust internal processes, invest in basic training, or seek external professional guidance to manage their Withholding Tax in Kenya obligations effectively. Overcoming these hurdles is crucial for long-term tax health and business stability.

XIV. Practical Tips for Startups to Manage Withholding Tax

Understanding the challenges of Withholding Tax in Kenya is one thing; effectively overcoming them is another. For Kenyan startups, implementing practical strategies and leveraging available tools can transform WHT from a source of anxiety into a manageable, routine compliance task. Here are actionable tips to help your startup stay on top of its WHT obligations:

Automate Using Accounting Software

Manual tracking of WHT deductions and remittances, especially as your startup scales, is highly prone to errors and incredibly time-consuming. Leveraging accounting software can significantly streamline this process.

- Integrated Features: Many modern accounting software solutions offer features that can help you track WHT. When you enter a supplier invoice, you can often configure the system to automatically calculate and flag WHT.

- Generate Reports: These systems can generate reports that summarize all WHT deducted, making monthly filing on iTax much easier.

- Popular Tools:

- QuickBooks Online: Widely used, it has features that can be customized to handle WHT calculations and reporting for Kenyan businesses.

- Xero: Another cloud-based accounting software that offers robust reporting and can be set up to manage WHT.

- SAGE: Offers various accounting solutions, some of which are tailored for specific regional tax requirements.

- Even Simpler Tools: If full accounting software is too much initially, set up a dedicated Excel template. This template should include columns for:

- Date of payment

- Payee Name

- Payee KRA PIN

- Gross Payment Amount

- Type of Income (e.g., Professional Fee, Rent)

- WHT Rate

- WHT Amount Deducted

- Net Amount Paid

- Date Remitted to KRA

- PRN (Payment Registration Number)

Train Your Finance Team

Even if you have a small team, ensuring everyone involved in payments understands WHT is crucial.

- Basic Training Sessions: Conduct short, regular training sessions for anyone involved in preparing payment vouchers, approving invoices, or managing bank reconciliations.

- Key Topics: Cover the basics:

- What Withholding Tax in Kenya is.

- The common types of payments that attract WHT (e.g., professional fees, rent).

- How to identify resident versus non-resident payees.

- The current WHT rates.

- The monthly deadline (20th of the following month).

- The importance of collecting KRA PINs and, for non-residents, Tax Residency Certificates.

- Resource Library: Create a simple internal resource library with KRA links, your WHT Excel template, and quick reference guides.

Work with Certified Tax Professionals

Don’t hesitate to seek expert help, especially in the early stages or for complex transactions.

- Initial Setup Guidance: A tax consultant can help you set up your accounting system correctly to handle WHT from day one.

- Complex Cases: For payments to non-residents, understanding Double Taxation Treaties, or navigating KRA audits, a certified tax professional is invaluable. They can ensure you leverage DTTs correctly and avoid costly mistakes.

- Outsourcing: Consider outsourcing your payroll and tax compliance to a reputable accounting firm. This can be more cost-effective than hiring a full-time expert and ensures professional handling of your Withholding Tax in Kenya and other tax obligations.

- Finding Professionals: Look for Certified Public Accountants (CPAs) or tax consultants registered with bodies like ICPAK (Institute of Certified Public Accountants of Kenya).

Checklist for Monthly WHT Tasks

A simple checklist can ensure no deadline is missed and all necessary steps are completed.

- End of Month:

- Review all payments made during the month.

- Identify all payments subject to Withholding Tax in Kenya.

- Ensure WHT was correctly calculated and deducted for each applicable payment.

- Confirm you have KRA PINs for all resident payees and, if applicable, Tax Residency Certificates for non-resident payees.

- By the 15th of the Following Month:

- Compile all WHT amounts deducted during the previous month.

- Log in to iTax and prepare the WHT return.

- Generate the PRN.

- By the 20th of the Following Month:

- Ensure the payment for the WHT (using the PRN) is remitted to KRA via bank or mobile money.

- Generate and issue WHT certificates to all payees (this can be done after remittance).

- File and save all supporting documents (invoices, PRNs, certificates) in your designated WHT folder.

Tool Suggestions for Kenyan Startups:

- Accounting Software: QuickBooks, Xero, SAGE (for automated tracking and reporting).

- KRA iTax Portal: Your primary platform for filing and generating PRNs.

- Microsoft Excel/Google Sheets: For creating simple, custom WHT tracking templates if you’re not yet using full accounting software.

- Canva/Figma: For creating visually clear internal guides or payment instruction visuals.

By adopting these practical tips, your startup can transform Withholding Tax in Kenya compliance from a daunting chore into a streamlined, error-free process, allowing you to focus more on innovation and growth.

XV. Final Thoughts: How to Stay Compliant and Confident

Navigating the tax landscape, especially the intricacies of Withholding Tax in Kenya, can seem like a complex journey for any startup. However, as we’ve explored throughout this comprehensive guide, mastering WHT compliance is not just about adhering to legal requirements; it’s about building a robust, credible, and sustainable foundation for your business’s growth in the Kenyan market.

Recap of Opportunities and Challenges

We’ve delved into why Withholding Tax in Kenya matters, from avoiding hefty penalties and interest to enhancing your eligibility for crucial tenders and investment opportunities. We’ve also highlighted the common challenges – from cash flow impact and varying rates to the administrative burden and the critical need for in-house expertise or reliable professional support.

- Blogging as Digital Entrepreneurship: While the article focuses on WHT, it’s worth noting that managing these compliance aspects is a critical skill for any digital entrepreneur operating in Kenya. Just as you build a compelling online presence, you must build a strong financial and legal backbone for your venture.

- Low Capital but High Potential: Startups often begin with minimal capital but immense potential. Protecting that potential by ensuring full tax compliance is a non-negotiable. The costs of non-compliance far outweigh the perceived savings or convenience of ignoring WHT.

Final Tips for Aspiring Bloggers (and Startup Founders!)

While this guide focuses on Withholding Tax in Kenya, the principles of consistency, value creation, continuous learning, and adaptability are universal, whether you’re building a blog or a booming startup.

- Be Proactive, Not Reactive: Don’t wait for KRA to send you a penalty notice or an audit query. Integrate WHT into your monthly financial routines. Plan for the deductions, budget for the remittances, and stay ahead of the 20th-of-the-month deadline. Proactivity saves you money, time, and stress.

- Focus on Value Creation (and Compliance): Your primary goal is to create value for your customers. But remember, a legally compliant and financially sound business structure is part of that value creation, enabling you to operate without fear of disruption.

- Keep Learning and Adapting: Tax laws, including those related to Withholding Tax in Kenya, are dynamic. KRA frequently issues circulars, and the annual Finance Act can introduce significant changes. Subscribe to KRA newsletters, follow reputable tax advisory firms in Kenya, and set aside time to review updates.

- Utilize KRA Resources: The KRA iTax portal offers various functionalities, FAQs, and contact points for assistance. Don’t hesitate to refer to their official guides or use their online inquiry system for clarifications. Remember, KRA’s primary goal is to collect revenue, but they also offer support for taxpayers to comply.

- Plan for WHT in Your Budgets: When negotiating with suppliers, consultants, or landlords, always factor in the Withholding Tax in Kenya component. It’s a statutory deduction and part of the overall cost of doing business. Ensure your cash flow projections account for the WHT remittance by the due date.

- Where to Get Help: For any complex or ambiguous WHT scenarios – particularly those involving international payments, Double Taxation Treaties, or specific industry nuances – always consult with a qualified tax professional in Kenya. They can provide tailored advice and ensure you remain fully compliant, mitigating risks.

By embracing a disciplined approach to Withholding Tax in Kenya, your startup not only fulfills its legal obligations but also cultivates a strong reputation, attracting more opportunities for investment, partnerships, and ultimately, sustainable success in the vibrant Kenyan economy. Compliance is not a burden; it’s a foundation.